How to Build the Best Trading Strategy for Any Market Condition

Building the best trading strategy isn’t just about following popular indicators or copying others’ methods. A truly effective trading strategy adapts to changing market conditions and fits your personal trading style, risk tolerance, and goals. Whether you trade stocks, forex, commodities, or cryptocurrencies, understanding how to create a versatile plan can make the difference between consistent growth and frustrating losses.

This guide breaks down how to design a robust and flexible trading approach that works across different markets and economic environments, helping you trade with confidence and discipline.

Understanding What Makes a Strategy “the Best”

Before you can create the best trading strategy, you need to define what “best” really means. For some traders, it’s about maximizing profits. For others, it’s about minimizing risk or achieving steady, long-term results.

A good strategy should meet a few essential criteria:

- Consistency: It performs reasonably well across various market conditions.

- Clarity: Rules are simple enough to follow without emotional interference.

- Adaptability: It can adjust to changes in volatility, trends, or market cycles.

- Risk Management: It limits potential losses while allowing for sustainable growth.

The key is not perfection but balance—finding a plan that suits your personality, risk appetite, and time availability.

Step 1: Define Your Market and Timeframe

Every market behaves differently. Stocks may respond to earnings reports and macroeconomic data, while forex depends on interest rates and geopolitical events. Before creating a strategy, choose one market to specialize in and a timeframe that matches your lifestyle.

- Scalpers focus on small, quick trades and prefer short timeframes like 1-minute or 5-minute charts.

- Day traders enter and exit within a single day, relying on intraday price action.

- Swing traders hold positions for days or weeks, capturing medium-term moves.

- Position traders look for long-term opportunities, often following major trends.

Once you pick your preferred market and timeframe, study its price patterns, trading hours, and volatility characteristics. This foundational knowledge will guide your next steps.

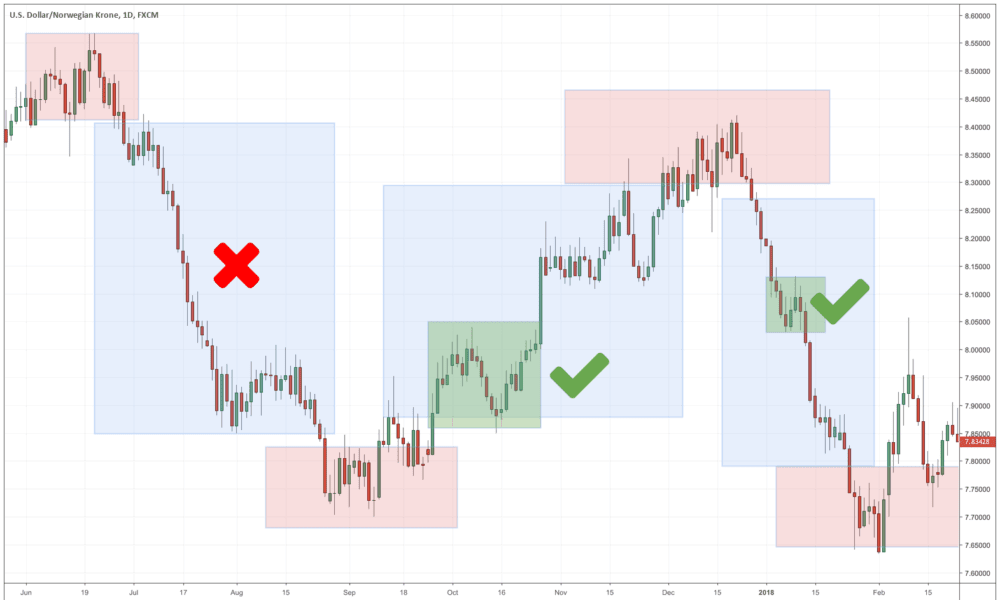

Step 2: Analyze Market Structure and Behavior

Market structure analysis is the backbone of any strong strategy. You need to recognize trends, reversals, and consolidation phases.

Start by identifying the three basic market conditions:

- Trending: Prices move in one clear direction, either up or down.

- Ranging: Prices fluctuate within a defined horizontal zone.

- Volatile or Choppy: Movements are irregular with no clear pattern.

Your trading plan should include setups for each of these scenarios. For instance, trend-following strategies like moving average crossovers work well in trending markets, while range-trading setups using support and resistance levels perform better during sideways conditions.

Step 3: Choose Your Indicators Wisely

Indicators can enhance your analysis, but too many can cause confusion. The best trading strategy relies on simplicity rather than complexity.

Consider combining different types of indicators for a complete view:

- ظTrend Indicators: Moving Averages, MACD, or ADX help identify direction.

- Momentum Indicators: RSI or Stochastic show overbought or oversold conditions

- Volatility Indicators: Bollinger Bands or ATR measure price fluctuations.

- Volume Indicators: On-Balance Volume (OBV) confirms the strength of moves.

For example, you might use a moving average to confirm the trend and an RSI to time entries and exits. Keep your setup minimal—two or three complementary indicators are usually enough.

Step 4: Establish Entry and Exit Rules

Without clear entry and exit rules, even the smartest analysis can lead to inconsistent results. Your rules should be specific, testable, and repeatable.

For entries, decide:

- What signals will trigger your trade (indicator crossovers, breakouts, candlestick patterns)?

- What confirmation do you need (trend alignment, volume increase)?

For exits, determine:

- Your profit target (e.g., risk-to-reward ratio of 1:2 or higher).

- Your stop-loss level (percentage or technical level like recent swing highs/lows).

- When to exit early if conditions change or signals reverse.

Remember that discipline in following your plan is as important as the plan itself. Emotional decisions often lead to mistakes that could have been avoided.

Step 5: Implement Strong Risk Management

Even the best trading strategy can fail without proper risk control. Successful traders think about protecting their capital first, profits second.

Here are essential risk management principles:

- Never risk more than 1–2% of your total account balance on a single trade.

- Use stop-loss orders to limit losses automatically.

- Adjust position sizes according to volatility and account size.

- Diversify across instruments or sectors to reduce exposure.

By focusing on risk first, you’ll stay in the game long enough for your edge to work in your favor.

Step 6: Backtest and Forward Test Your Strategy

Once your plan is ready, it’s time to see how it performs. Backtesting uses historical data to test your strategy’s rules, while forward testing applies those rules in real-time using a demo or small live account.

Look for these key performance metrics:

- Win rate: Percentage of successful trades.

- Profit factor: Ratio of total profits to total losses.

- Drawdown: The largest percentage loss from peak to trough.

- Consistency: How stable your returns are over different periods.

Testing allows you to refine your rules, identify weaknesses, and gain confidence before trading with larger capital.

Step 7: Keep Your Emotions in Check

Trading psychology can make or break your results. Fear, greed, and impatience often cause traders to abandon even the best trading strategy at the wrong time.

To stay emotionally balanced:

- Use a trading journal to track performance and emotions.

- Avoid overtrading after wins or revenge trading after losses.

- Set realistic goals and accept that losses are part of the process.

- Stick to your strategy no matter how tempting it is to deviate.

Over time, emotional control becomes your greatest competitive advantage in the markets.

Step 8: Continuously Improve and Adapt

Markets evolve, and so should your strategy. What works today may not work tomorrow. Regularly review your performance and adapt to new data, volatility levels, and global events.

Some traders use a hybrid approach, combining elements of trend following and mean reversion depending on conditions. Others automate parts of their trading with algorithmic systems. The key is to remain flexible and data-driven rather than emotional or rigid.

Keep learning from your trades—both good and bad—and stay updated on macroeconomic trends, central bank policies, and technological changes that influence market behavior.

Final Thoughts: Building Confidence Through Consistency

Crafting the best trading strategy for any market condition isn’t about finding a magic formula. It’s about designing a clear, adaptable, and disciplined system that fits your personality and financial goals. Focus on structure, testing, and risk control rather than chasing every new trading trend.

Remember, every professional trader starts with the same foundation: understanding the market, managing emotions, and protecting capital. With consistent practice, data-driven decision-making, and patience, you can build a strategy that not only survives but thrives across market cycles.

The true power of trading lies not in predicting markets but in preparing for them. By mastering your plan and refining it over time, you’ll gain the confidence and resilience needed to succeed—no matter what the market throws your way.

Source: How to Build the Best Trading Strategy for Any Market Condition